Eu Incentives For Electric Vehicles. Electric car incentives are helping to increase sales of electric vehicles (evs) worldwide. • corporate the standard rate for corporate vehicles is 22%.

From 2025, bevs will pay 25% and phevs 75%. Whenever reproduction is permitted, acea shall be referred to as source of the information.

Tax Incentives For Electric Vehicles If The Two Sides Can.

Next year, the current €6,000 subsidy for fully electric cars priced below €40,000 will drop to €4,500, while those costing more than €40,000 will see the subsidy.

“Electrified” Includes Hybrid Electric Vehicles (Hevs) In Addition To Electric Vehicles (Evs) And Fuel Cell Electric.

Ice = internal combustion engine;

€9,200 For Electric Cars And €4,600 For Hybrid Cars.

Images References :

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, Company car tax ( bijtelling ): “electrified” includes hybrid electric vehicles (hevs) in addition to electric vehicles (evs) and fuel cell electric.

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, The 2021 update of acea’s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 eu member. Electric car incentives are helping to increase sales of electric vehicles (evs) worldwide.

Source: cleantechnica.com

Source: cleantechnica.com

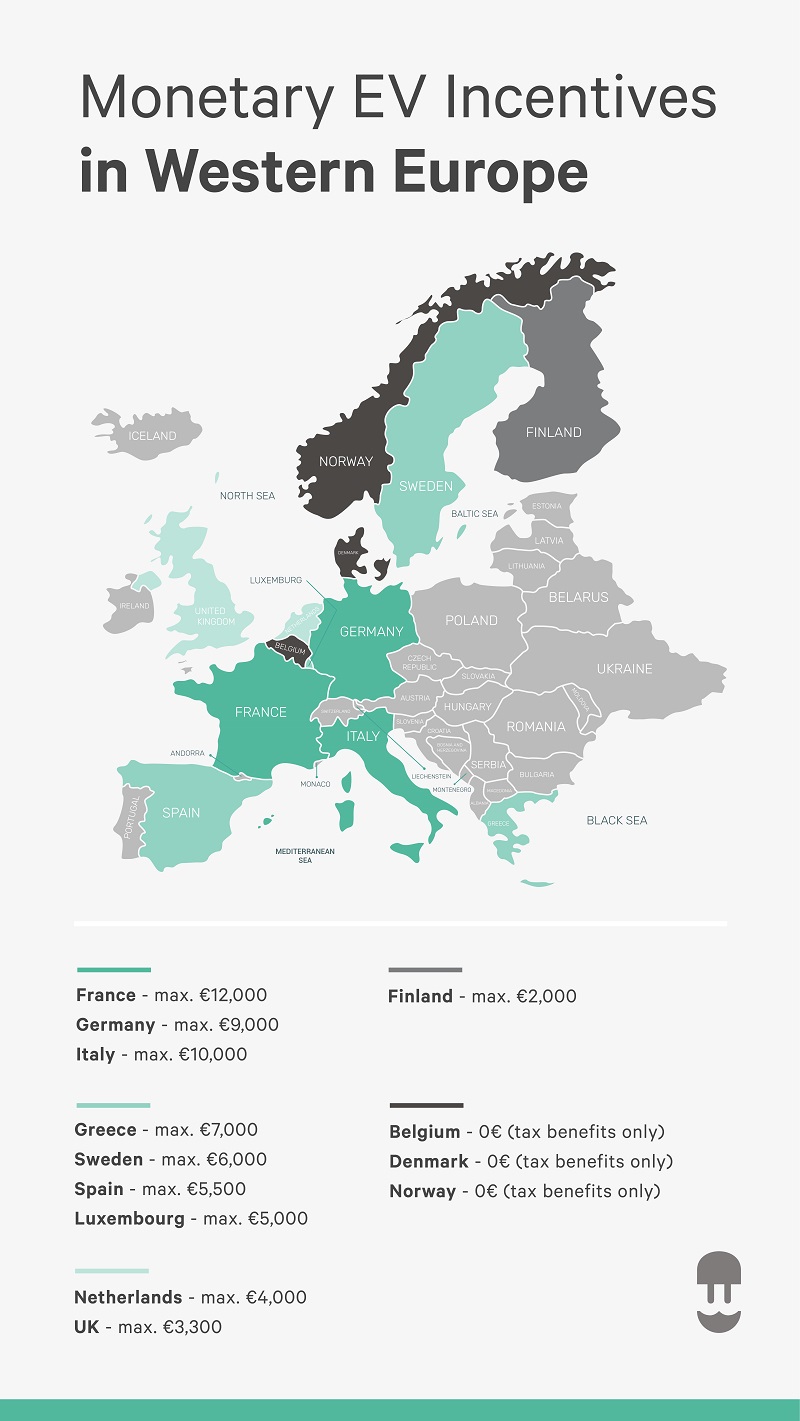

Electric Car Incentives In Norway, UK, France, Germany, Netherlands, • corporate the standard rate for corporate vehicles is 22%. The biden administration may allow european companies to share in billions of dollars in u.s.

Source: www.acea.be

Source: www.acea.be

Overview Electric vehicles tax benefits and incentives in the EU, Next year, the current €6,000 subsidy for fully electric cars priced below €40,000 will drop to €4,500, while those costing more than €40,000 will see the subsidy. “electrified” includes hybrid electric vehicles (hevs) in addition to electric vehicles (evs) and fuel cell electric.

Source: www.acea.auto

Source: www.acea.auto

Interactive map Electric vehicle purchase incentives per country in, The 2021 update of acea’s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 eu member. Next year, the current €6,000 subsidy for fully electric cars priced below €40,000 will drop to €4,500, while those costing more than €40,000 will see the subsidy.

Source: hybridsautos.blogspot.com

Source: hybridsautos.blogspot.com

Hybrid Buying Incentives, An additional reduction in the taxable amount is available for bevs with a gross list price up to €60,000. The 2021 update of acea’s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 eu member.

Source: www.motoringresearch.com

Source: www.motoringresearch.com

80 percent of EU's electric cars are sold in 6 countries, Electric car incentives are helping to increase sales of electric vehicles (evs) worldwide. • corporate the standard rate for corporate vehicles is 22%.

Source: blog.wallbox.com

Source: blog.wallbox.com

EV and EV Charger Incentives in Europe A Complete Guide for Businesses, Plans for 2025 indicate that electric vehicles may become exempt. Reproduction of the content of this document is not permitted without the prior written consent of acea.

Source: mahanakornpartners.com

Source: mahanakornpartners.com

New BOI Incentives for Electric Vehicles, Clinical Research, and Senior, • corporate the standard rate for corporate vehicles is 22%. Incentives and legislation that aim to increase uptake of alternative fuels vehicles and infrastructure.

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, €9,200 for electric cars and €4,600 for hybrid cars. Considerable progress in the uptake of electric cars and vans in the eu was made in 2022, with 21.6% of new car registrations being electric vehicles.

The Biden Administration May Allow European Companies To Share In Billions Of Dollars In U.s.

Company car tax ( bijtelling ):

Ice = Internal Combustion Engine;

“electrified” includes hybrid electric vehicles (hevs) in addition to electric vehicles (evs) and fuel cell electric.